We don't consider your personal objectives, financial situation or needs and we aren't recommending any specific product to you. Mozo provides general product information. ^See information about the Mozo Experts Choice Home Loan Awards Actual repayments will depend on your individual circumstances and interest rate changes.

Rates, fees and charges and therefore the total cost of the loan may vary depending on your loan amount, loan term, and credit history. You can change the loan amount and term in the input boxes at the top of this table. Initial monthly repayment figures are estimates only, based on the advertised rate. The comparison rate displayed is for a secured loan with monthly principal and interest repayments for $150,000 over 25 years. Costs such as redraw fees or early repayment fees, and cost savings such as fee waivers, are not included in the comparison rate but may influence the cost of the loan. Different amounts and terms will result in different comparison rates. WARNING: This comparison rate applies only to the example or examples given. If you find yourself overwhelmed with all the home loans jargon check out Mozo’s Home Loan Glossary where we simplify and define all those fancy home loan terms. It continues that way until the complete loan has been used. If later in the construction stages Amy and Rosa draw $30,000 for the next phase of the construction, then they’ll be charged interest on $50,000. Since, you’ll be borrowing money by increments you’ll typically only pay interest on the amount of the loan you’ve drawn down so far.įor example, Amy and Rosa got approved for a $300,000 construction loan but have only drawn down $20,000 so far: they’ll only be charged interest for the $20,000. A typical construction loan drawdown consists of five to six stages. How do drawdown loans work for construction loans? Well it uses progressive drawdowns, where you can draw on your construction loan as needed throughout the different phases of construction. Then they will become the official homeowners of the new property.Ĭonstruction loan and drawing down in stages Come the official settlement date, Ana and Kate’s lender will draw down the remaining $560,000 to pay the vendor.

DRAWDOWN MEANING IN FINANCE HOW TO

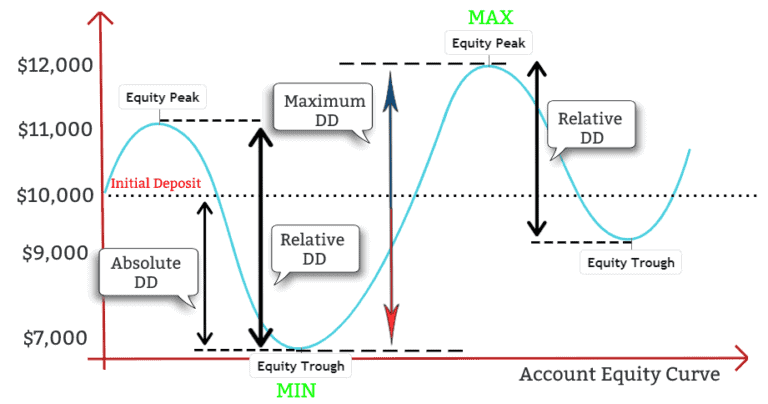

They follow the Mozo how to buy your first home guide and conduct their due diligence of inspecting the property and getting financial approval. After paying their $140,000 deposit and receiving the final contract, Ana and Kate have five weeks until their settlement date. On this day your solicitor will arrange with the vendor’s solicitor and communicate with your lender to organise the drawdown of the remaining funds to pay for the property.įor example, Ana and Kate recently bought their first home for $700,000. Settlement day typically occurs after you’ve paid your deposit and completed the contract that makes you the new homeowner. On the other hand, with a construction loan, money is drawn down in multiple payments as the builders complete different stages of the construction project.Īccessing your home loan on settlement day

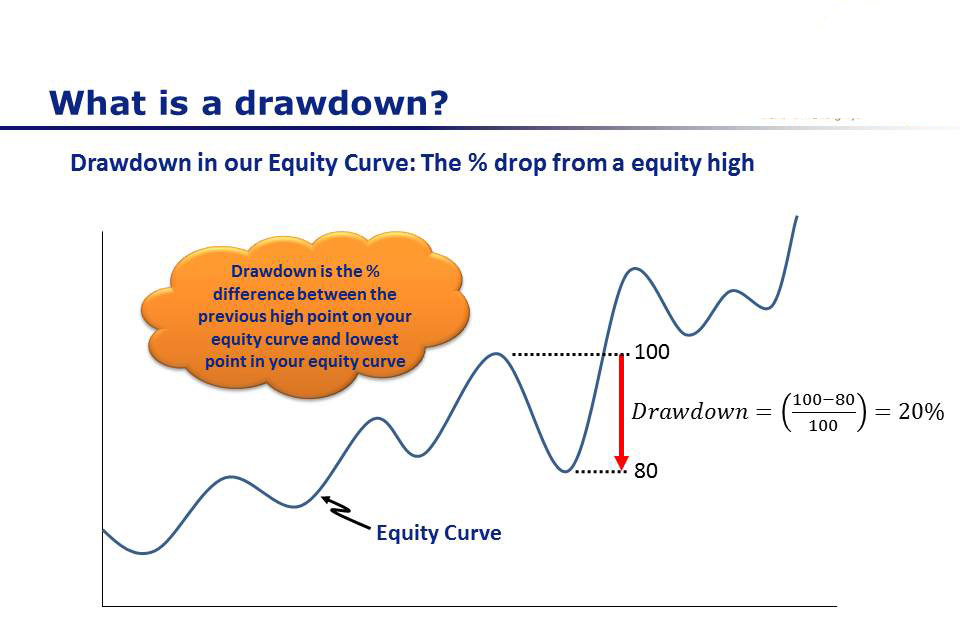

Lenders use this term to describe when your loan is actually paid to you, usually on settlement of the property. When it comes to home loans, ‘drawdown loan’ means you are using the money the lender provided to buy the property. Ever wondered a drawdown means? In simple terms a loan drawdown is the release of funds under an agreement with a lender.

0 kommentar(er)

0 kommentar(er)